Global South

Wed, 01 May 2024 00:34:02 +0000

1. War, they say

War, regional war

Until the philosophy which hold one race superior

And another inferior

Is finally and permanently discredited

And abandoned

Everywhere is war

Me say war

The assumption is that the west will start whatever war may break out and nobody else, besides in case of self-defense – recent case in point, Iran.

My thesis is that the US and its lapdogs cannot make war today excepting if they depend heavily on proxies and socalled friends. Who can that be? And that is a major reason why the west has not been attacked. Who wànts to shoot lapdogs and proxies. Russia and China sure is not into that.

Lets take a look at the Combatant Commands: Africa, Central Europe, Indo Pacific, Northern, Southern command centers are all geographically defined and then there are a few based on function for example Transportation. Those are not important for our purpose here

Continuing with my regional thesis and looking at the commands, it is dead easy to choose which countries are western centric and which not.. that is however not the only criterion. Now I will develop a set of criteria. It gets dirty there at the end. I cannot help it as we are trying to find rational behaviour from deepfake US idiots.

1. Breaking down to the countries in each command, which are western centric and which not, brings one to a regional distribution of who possibly can take part in war. I'm ignoring the power of the purse for now.

2. Which are worth having at your warring side. We only need to look at the Ukraine which ia a total and

utterly defeated force but with another bunch of money, where-ever it is spent, the internal US charade of being at war can continue. And it is regional and the pretence that it threatens Russia can continue.

3. Who is supposedly the enemy? There are only two enemies of note for the west, China and Russia. The regional enemies will be chosen as to who is perceived to be the most effective to break apart China and Russia.

4. The wars' timescale depends on how much lying to themselves can be tolerated. Acçording to Dr. Hudson this is now the third time that the US is going through an identical process where students and their teachers are out in the streets and on their campuses being arrested for their protest against Israel killing Gaza and the Palestinians. (Communist scare, Vietnam and now called anti-semitism). Evidently they do not learn fast.

5. When and how will this war or rather regional facsimilies be won? Dunno – forever. 'We the empire will take the Ukraine as our example or test case and we can run these regional wars forever.' (My mind keeps jumping to them waiting for a messiah or a few rescuers from space ET movie style.)

Now that my criteria are visiting lala land, because this trajectory resembles nothing less, we have to visit one truth – the west will not stop escalating until they get kicked in the teeth. More seriously, we will see a perpetual regional war scenario play out. This morning someone played some music and I noted that it was violent (In a Spanish street slang that I could not pick up but the sensse was clear). They were howling about the interference in LatAm. Now towards cannon fodder – this migrant caravan is really well organized. Every point of stopping has rest houses with fresh clothes and gifts. No more can be said but I have a few t's. Quality unbelievable – soft, perfect cut and exactly what the latest migrant should wear. Great regional cannon fodder is being transported in with soft new t's to wear.

The war attempts will be regional and will be present until the philosopy is finally and permanently discredited. Can someone not just kick 'em in the teeth? I guess we have a whole Gaza killing spree to take as our topical example.

—

War by Bob Marley

Tue, 30 Apr 2024 18:53:54 +0000

2. Students – Triggers to Stop Wars?

Top Universities' Pro-Palestine Encampments – A shift Towards Justice or Just Illusion?

Peter Koenig

30 April 2024

"The whole world thinks that Gaza is occupied by Israel.

The truth is that the whole world is occupied by Israel except Gaza." (anonymous)

This makes sense, as the whole world – or its western "leaders" (sic) – is cheering for Zionist-Israel. But Gaza and Palestine are defending their turf. Not to be occupied by Israel.

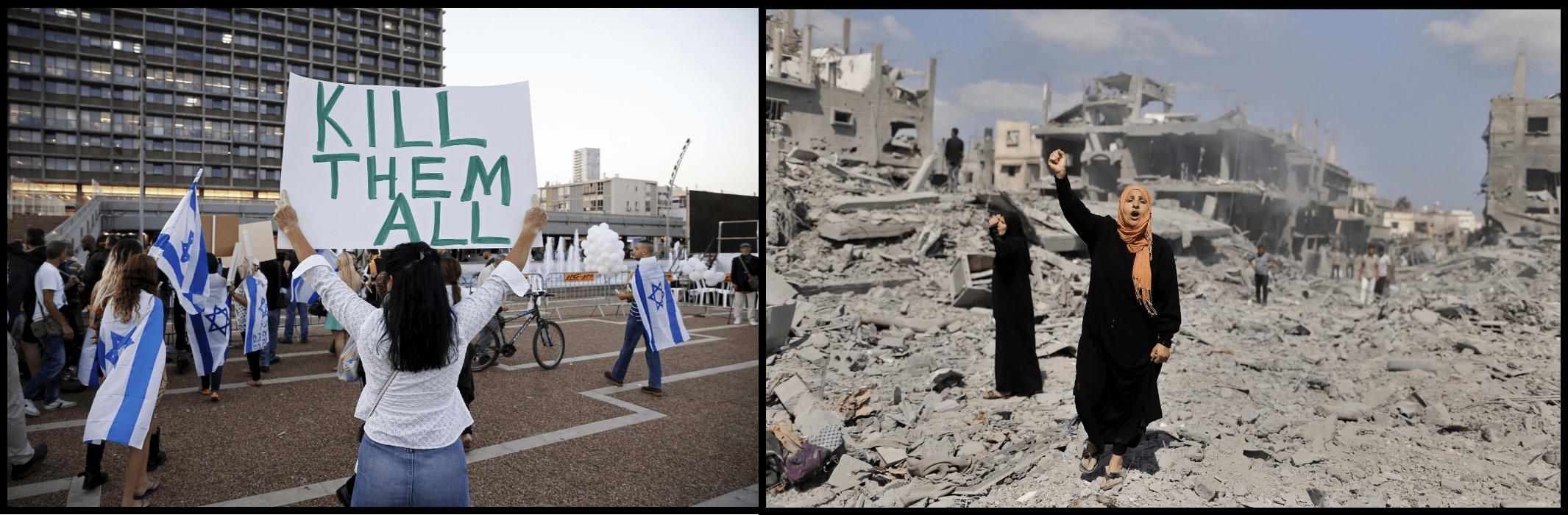

They will succeed. At a high cost. Yes. But Palestine will prevail. They will not be defeated, and the Zionist atrocities, the endless horrifying torture, the indiscriminate killing, bombing, shooting, destruction of vital infrastructure, hospitals, schools – more than 40,000 Palestinians killed, most of them in Gaza – of whom more than 70% women and children – MUST not go unpunished.

The Nuremberg Codex on War Crimes and Human Rights MUST be revived.

In the last few days, mainstream and non-mainstream media reported of massive student encampments, protesting for Gaza, for Palestine against Zionist-Israel. It is almost reminiscent of anti-Vietnam War movements of the late 60s and early 70s.

In the last few days, mainstream and non-mainstream media reported of massive student encampments, protesting for Gaza, for Palestine against Zionist-Israel. It is almost reminiscent of anti-Vietnam War movements of the late 60s and early 70s.

According to Resistance News Network (@RNN_Messaging_Bot), this appears to be happening at more than 45 top universities around the world, including dozens in the US. Many of them Ivy League learning institutes, such as MIT, Harvard, Yale, Berkley, UCLA, Brown, Colombia, Emery, City University NYC – and many more.

They are joined by universities in Australia and France.

How real is this? – A unilateral defense cry for Palestine, not only by Palestinian and Arab students – but by students of all colors and creeds in solidarity.

Knowing that these largely Zionist-funded universities are likely going to crack down on these encampments – what has already started – students may be suspended.

Then, all of a sudden appears a more sobering set of news – namely that Soros's Open Society Foundation is funding most of the student anti-Israel protests, as reported three days ago by RT. [01]

Why would Soros, the Woke Master – suddenly fund anti-Israel cum Zionist protests around the globe, of course, with focus on the US?

"Divide-to-Conquer"?

Creating "False Flags"?

Making believe that there is a huge pro-Palestine move taking place at US universities?

It may give universities' administrators the opportunity to officially – with much fanfare – crack down on student camps on university grounds, demonstrating concerned universities pro-Zionist-Israel stand (naturally, supporting their funders), letting future students know what they may be up to, in case they decide to apply to these universities.

The emerging Bigger Picture might be that student protests can be wiped out by the Powers-that-be, easily supported by the system's forces of order, police, and military, if needed.

In which case Soros' agenda is pro-Israel, pro WEF, similarly as the Woke Movement supports the objectives of the WEF's Great Reset and the UN Agenda 2030 – massive population reduction and control of every corner of human existence.

Almost simultaneously appear new speculations. RT reports that the International Criminal Court (ICC) could charge Israeli Prime Minister Benjamin Netanyahu and his top officials with war crimes and issue warrants for their arrest as early as this week. This is based on an NBC News report of 29 April 2024. Also included in warrants issued may be Defense Minister Yoav Gallant, army chief Herzl Halevi, and other unnamed senior military officers.

Almost simultaneously appear new speculations. RT reports that the International Criminal Court (ICC) could charge Israeli Prime Minister Benjamin Netanyahu and his top officials with war crimes and issue warrants for their arrest as early as this week. This is based on an NBC News report of 29 April 2024. Also included in warrants issued may be Defense Minister Yoav Gallant, army chief Herzl Halevi, and other unnamed senior military officers.

However, another sobering note, in NBC's own words, "Israel is working through diplomatic channels to try to stop the warrants being issued."

Does anybody believe, Israel may fail in her attempt to stop the warrants?

Who controls the ICC? – Or asked differently, who dares going against the Zionist's and Zionist-Washington's "wishes"?

The ICC simply told NBC that it "has an ongoing independent investigation in relation to the situation in the State of Palestine" and has "no further comment to make at this stage." [02]

What if – the so-called student movement, the ICC "attempt" to arrest top Israeli officials, including the Prime Minister, other apparently increasing protests around the globe against Israel – is but a new propaganda sting, demonstrating that despite all opposition to Zionist-Israel wiping Palestine off the map – stopping Zionism is not going to happen.

What if – the so-called student movement, the ICC "attempt" to arrest top Israeli officials, including the Prime Minister, other apparently increasing protests around the globe against Israel – is but a new propaganda sting, demonstrating that despite all opposition to Zionist-Israel wiping Palestine off the map – stopping Zionism is not going to happen.

In the words of "anonymous", above – "The truth is that the whole world is occupied by Israel except Gaza."

Once this lesson sinks in – the world may wake up and have a chance to free itself from Zionism's evil claws.

————

Peter Koenig is a geopolitical analyst and a former Senior Economist at the World Bank and the World Health Organization (WHO), where he worked for over 30 years around the world. He is the author of Implosion – An Economic Thriller about War, Environmental Destruction and Corporate Greed; and co-author of Cynthia McKinney's book "When China Sneezes: From the Coronavirus Lockdown to the Global Politico-Economic Crisis" (Clarity Press – November 1, 2020)

Peter is a Research Associate of the Centre for Research on Globalization (CRG).

He is also a non-resident Senior Fellow of the Chongyang Institute of Renmin University, Beijing.

Tue, 30 Apr 2024 17:43:12 +0000

3. Empire Besieged

Nothing works to quell the Resistances in West Asia or the Sahel.

Police viciousness sets in within the imperial core.

We're in a screeching, bargaining, retreat phase..

Garland Nixon interviews Laith Marouf — Tuesday's West Asia and World update.

Deep breathes before Rafah and Lebanon. US students on front lines. The sheer agony of the Empire stuck in the tar-pit, or rather the "rasputitsa of the global Resistance."

"skirmishes" between zionists and Hezbollah in north Palestine reached levels last seen in 2006 war

"skirmishes" between zionists and Hezbollah in north Palestine reached levels last seen in 2006 war

They got Joe Biden in Mali!

They got Joe Biden in Mali!

Ramifications of losing Palestine for Empire: EVERY prior Sea Power (thalassocracy) that didn't control this vital key connectivity corridor of mankind and mare nostrum, FAILED. This region is most important communication and transport juncture in our world, since dawn of antiquity. Losing Palestine: a drastric Retreat for USUK. Which would have global domino effect, as already being seen in the African Sahel….

Ramifications of losing Palestine for Empire: EVERY prior Sea Power (thalassocracy) that didn't control this vital key connectivity corridor of mankind and mare nostrum, FAILED. This region is most important communication and transport juncture in our world, since dawn of antiquity. Losing Palestine: a drastric Retreat for USUK. Which would have global domino effect, as already being seen in the African Sahel….

Given such importance of sequelae over future control over much of mankind, every upcoming atrocity and entrenchment of Genocide against Palestinians, and wider region, will NOT faze the crazed Hegemon

Given such importance of sequelae over future control over much of mankind, every upcoming atrocity and entrenchment of Genocide against Palestinians, and wider region, will NOT faze the crazed Hegemon

Geography, and position of Yemen, will continue to squeeze and attrit Empire, in spite of having reconquered the abject Egyptian elites. What use is controlling Suez today?!!

Geography, and position of Yemen, will continue to squeeze and attrit Empire, in spite of having reconquered the abject Egyptian elites. What use is controlling Suez today?!!

this hydrid world war is being fought in astonishing ways. Last time, it would have been de rigueur, to invade and retake Egypt, in order to free Palestine. Now, Egypt is left in place, its economy collapsed through starving the Suez canal and other measures, and the task left to Egyptians to free themselves. In the meantime, broke Egypt, like 404, and Zion, has become another imperial albatross and unaffordable expense item. As the lunatics fight for land, whilst losing manpower in 404, and thus the war, so in Egypt they are guaranteed in losing in the long run, through a change of elites

this hydrid world war is being fought in astonishing ways. Last time, it would have been de rigueur, to invade and retake Egypt, in order to free Palestine. Now, Egypt is left in place, its economy collapsed through starving the Suez canal and other measures, and the task left to Egyptians to free themselves. In the meantime, broke Egypt, like 404, and Zion, has become another imperial albatross and unaffordable expense item. As the lunatics fight for land, whilst losing manpower in 404, and thus the war, so in Egypt they are guaranteed in losing in the long run, through a change of elites

the alliances of Axes of Resistance consult and bolster each other — worldwide.

the alliances of Axes of Resistance consult and bolster each other — worldwide.

the traitorous Palestinian Authority cadre around Abbas needs to go. Algeria, Russia and now China is trying to reconcile the Palestinian factions. They have no hope — being abject compradore quislings who cannot change.

the traitorous Palestinian Authority cadre around Abbas needs to go. Algeria, Russia and now China is trying to reconcile the Palestinian factions. They have no hope — being abject compradore quislings who cannot change.

Lebanese students stand in solidarity with protesting US students' bravery

Lebanese students stand in solidarity with protesting US students' bravery

More severe repression is likely against US campus protesters — again, linked to prestige and maintenance of EMPIRE – which is impermissible to supremacist Exceptionals…

More severe repression is likely against US campus protesters — again, linked to prestige and maintenance of EMPIRE – which is impermissible to supremacist Exceptionals…

Those resistant to natural limits of power, will have them imposed as in 404..

Those resistant to natural limits of power, will have them imposed as in 404..

USUK ruling elite and their vassal compradores are completely isolated from all — worldwide leadership, peoples, and now their own people

USUK ruling elite and their vassal compradores are completely isolated from all — worldwide leadership, peoples, and now their own people

Are we gonna have an election in USA? Are they having one in 404? How to reconcile with a People going in an entirely DIFFERENT direction? Garland not sure an election is possible at all…

Are we gonna have an election in USA? Are they having one in 404? How to reconcile with a People going in an entirely DIFFERENT direction? Garland not sure an election is possible at all…

As it came out in 404, it will likely be determined that USUK denied and sabotaged the possibility of a Gaza Genocide ceasefire, not the hapless proxy zionists, foaming deranged though they be. Even they are worn out like UkroNazis and need a break

As it came out in 404, it will likely be determined that USUK denied and sabotaged the possibility of a Gaza Genocide ceasefire, not the hapless proxy zionists, foaming deranged though they be. Even they are worn out like UkroNazis and need a break

The Empire is stuck in both theaters, cannot get out, and is guaranteed of absolute defeat. If they increase physical presence and enlargen the war, it merely increases the cost of defeat, ensures closure of all shipping lanes, and collapses what is left of their economies. In West Asia, they've gotten caught by the SAME trap they laid for Russia in Europe. Compounding the Horror, the ongoing Genocide cannot also be stopped, as now linked to imperial prestige and power maintenance.

The Empire is stuck in both theaters, cannot get out, and is guaranteed of absolute defeat. If they increase physical presence and enlargen the war, it merely increases the cost of defeat, ensures closure of all shipping lanes, and collapses what is left of their economies. In West Asia, they've gotten caught by the SAME trap they laid for Russia in Europe. Compounding the Horror, the ongoing Genocide cannot also be stopped, as now linked to imperial prestige and power maintenance.

Tue, 30 Apr 2024 13:31:48 +0000

4. Civilization Will Triumph Over Barbarism

@karlof1: Dr. Hudson, an alumni of Columbia U, has written a scathing op/ed on the recent attack on students over the past two weeks calling Anti-Semitic the new epithet replacing Communism of the McCarthy Era and the notorious anti-democratic HUAC (House Unamerican Activities Committee) that existed from 1947-1975…

By Michael Hudson at michael-hudson.com

Universities as Tentacles of the Police State

"Have you no sense of decency?"

The recent Congressional hearings leading to a bloodbath of university presidents brings back memories from my teen-age years in the 1950s when everyone's eyes were glued to the TV broadcast of the McCarthy hearings. And the student revolts incited by vicious college presidents trying to stifle academic freedom when it opposes foreign unjust wars awakens memories of the 1960s protests against the Vietnam War and the campus clampdowns confronting police violence.

I was the junior member of the "Columbia three" alongside Seymour Melman and my mentor Terence McCarthy (both of whom taught at Columbia's Seeley Mudd School of Industrial Engineering; my job was mainly to handle publicity and publication). At the end of that decade, students occupied my office and all others at the New School's graduate faculty in New York City – very peacefully, without disturbing any of my books and papers.

Only the epithets have changed.

The invective "Communist" has been replaced by "anti-Semite," and the renewal of police violence on campus has not yet led to a Kent State-style rifle barrage against protesters. But the common denominators are all here once again. A concerted effort has been organized to condemn and even to punish today's nationwide student uprisings against the genocide occurring in Gaza and the West Bank. Just as the House Unamerican Activities Committee (HUAC) aimed to end the careers of progressive actors, directors, professors and State Department officials unsympathetic to Chiang Kai-Shek or sympathetic to the Soviet Union from 1947 to 1975, today's version aims at ending what remains of academic freedom in the United States.

The epithet of "communism" from 75 years ago has been updated to "anti-Semitism." Senator Joe McCarthy of Wisconsin has been replaced by Elise Stefanik, House Republican from upstate New York, and Senator "Scoop" Jackson upgraded to President Joe Biden. Harvard University President Claudine Gay (now forced to resign), former University of Pennsylvania President Elizabeth Magill (also given the boot), and Massachusetts Institute of Technology President Sally Kornbluth were called upon to abase themselves by promising to accuse peace advocates critical of U.S. foreign policy of anti-Semitism.

The most recent victim was Columbia's president Nemat "Minouche" Shafik, a cosmopolitan opportunist with trilateral citizenship who enforced neoliberal economic policy as a high-ranking official at the IMF (where she was no stranger to the violence of "IMF riots") and the World Bank, and who brought her lawyers along to help her acquiesce in the Congressional Committee's demands. She did that and more, all on her own. Despite being told not to by the faculty and student affairs committees, she called in the police to arrest peaceful demonstrators.

This radical trespass of police violence against peaceful demonstrators (the police themselves attested to their peacefulness) triggered sympathetic revolts throughout the United States, met with even more violent police responses at Emory College in Atlanta and California State Polytechnic, where cell phone videos were quickly posted on various media platforms.

Just as intellectual freedom and free speech were attacked by HUAC 75 years ago, academic freedom is now under attack at these universities. The police have trespassed onto school grounds to accuse students themselves of trespassing, with violence reminiscent of the demonstrations that peaked in May 1970 when the Ohio National Guard shot Kent State students singing and speaking out against America's war in Vietnam.

Today's demonstrations are in opposition to the Biden-Netanyahu genocide in Gaza and the West Bank. The more underlying crisis can be boiled down to the insistence by Benjamin Netanyahu that to criticize Israel is anti-Semitic. That is the "enabling slur" of today's assault on academic freedom.

By "Israel," Biden and Netanyahu mean specifically the right-wing Likud Party and its theocratic supporters aiming to create "a land without a [non-Jewish] people." They assert that Jews owe their loyalty not to their current nationality (or humanity) but to Israel and its policy of driving the Gaza Strip's millions of Palestinians into the sea by bombing them out of their homes, hospitals and refugee camps.

The implication is that to support the International Court of Justice's accusations that Israel is plausibly committing genocide is an anti-Semitic act. Supporting the UN resolutions vetoed by the United States is anti-Semitic.

The claim is that Israel is defending itself and that protesting the genocide of the Palestinians in Gaza and the West Bank frightens Jewish students. But research by students at Columbia's School of Journalism found that the complaints cited by the New York Times and other pro-Israeli media were made by non-students trying to spread the story that Israel's violence was in self-defense.

Most if not all of the so-called "Jewish students" whining about persecution on elite university campuses are, in fact, semi-professional, billionaire-backed Israel lobbyists weaponizing their identity to dismantle the First Amendment and defend genocide https://t.co/qKEzKPsBdi

— Max Blumenthal (@MaxBlumenthal) April 28, 2024

The student violence has been by Israeli nationals. Columbia has a student-exchange program with Israel for students who finish their compulsory training with the Israeli Defense Forces. It was some of these exchange students who attacked pro-Gaza demonstrators, spraying them with Skunk, a foul-smelling indelible Israeli army chemical weapon that marks demonstrators for subsequent arrest, torture or assassination. The only students endangered were the victims of this attack. Columbia under Shafik did nothing to protect or help the victims.

The hearings to which she submitted speak for themselves. Columbia's president Shafik was able to avoid the first attack on universities not sufficiently pro-Likud by having meetings outside of the country. Yet she showed herself willing to submit to the same brow-beating that had led her two fellow presidents to be fired, hoping that her lawyers had prompted her to submit in a way that would be acceptable to the committee.

I found the most demagogic attack to be that of Republican Congressman Rick Allen from Georgia, asking Dr. Shafik whether she was familiar with the passage in Genesis 12.3. As he explained, "It was a covenant that God made with Abraham. And that covenant was real clear. … 'If you bless Israel, I will bless you. If you curse Israel, I will curse you.' … Do you consider that to be a serious issue? I mean, do you want Columbia University to be cursed by God of the Bible?"

Shafik smiled and was friendly all the way through this bible thumping, and replied meekly, "Definitely not." She might have warded off this browbeating question by saying, "Your question is bizarre. This is 2024, and America is not a theocracy. And the Israel of the early 1st century BC was not Netanyahu's Israel of today." She accepted all the accusations that Allen and his fellow Congressional inquisitors threw at her.

Her main nemesis was Elise Stefanik, Chair of the House Republican Conference, who is on the House Armed Services Committee, and the Committee on Education and the Workforce.

Congresswoman Stefanik: You were asked were there any anti-Jewish protests and you said 'No'.

President Shafik: So the protest was not labeled as an anti-Jewish protest. It was labeled as an anti-Israeli government. But antisemitic incidents happened or antisemitic things were said. So I just wanted to finish.

Congresswoman Stefanik: And you are aware that in that bill, that got 377 Members out of 435 Members of Congress, condemns 'from the river to the sea' as antisemitic?

Dr. Shafik: Yes, I am aware of that.

Congresswoman Stefanik: But you don't believe 'from the river to the sea' is antisemitic?

Dr. Shafik: We have already issued a statement to our community saying that language is hurtful and we would prefer not to hear it on our campus.

What an appropriate response to Stefanik's browbeating might have been?

Shafik could have said, "The reason why students are protesting is against the Israeli genocide against the Palestinians, as the International Court of Justice has ruled, and most of the United Nations agree. I'm proud of them for taking a moral stand that most of the world supports but is under attack here in this room."

Instead, Shafik seemed more willing than the leaders of Harvard or Penn to condemn and potentially discipline students and faculty for using the term "from the river to the sea, Palestine will be free." She could have said that it is absurd to say that this is a call to eliminate Israel's Jewish population, but is a call to give Palestinians freedom instead of being treated as Untermenschen.

Asked explicitly whether calls for genocide violate Columbia's code of conduct, Dr. Shafik answered in the affirmative — "Yes, it does." So did the other Columbia leaders who accompanied her at the hearing. They did not say that this is not at all what the protests are about. Neither Shafik nor any other of the university officials say, "Our university is proud of our students taking an active political and social role in protesting the idea of ethnic cleansing and outright murder of families simply to grab the land that they live on. Standing up for that moral principle is what education is all about, and what civilization's all about."

The one highlight that I remember from the McCarthy hearings was the reply by Joseph Welch, the U.S. Army's Special Council, on June 9, 1954 to Republican Senator Joe McCarthy's charge that one of Welch's attorneys had ties to a Communist front organization. "Until this moment, senator," Welch replied, "I think I never gauged your cruelty or your recklessness. … Have you no sense of decency, sir? At long last, have you left no sense of decency?"

The audience broke into wild applause. Welch's put-down has echoed for the past 70 years in the minds of those who were watching television then (as I was, at age 15). A similar answer by any of the three other college presidents would have shown Stefanik to be the vulgarian that she is. But none ventured to stand up against the abasement.

The Congressional attack accusing opponents of genocide in Gaza as anti-Semites supporting genocide against the Jews is bipartisan. Already in December, Rep. Suzanne Bonamici (D-Ore.) helped cause Harvard and Penn's presidents to be fired for their stumbling over her red-baiting. She repeated her question to Shafik on April 17: "Does calling for the genocide of Jews violate Columbia's code of conduct?" Bonamici asked the four new Columbia witnesses. All responded: "Yes."

That was the moment when they should have said that the students were not calling for genocide of the Jews, but seeking to mobilize opposition to genocide being committed by the Likud government against the Palestinians with President Biden's full support.

During a break in the proceedings Rep. Stefanik told the press that "the witnesses were overheard discussing how well they thought their testimony was going for Columbia." This arrogance is eerily reminiscent to the previous three university presidents who believed when walking out of the hearing that their testimony was acceptable. "Columbia is in for a reckoning of accountability. If it takes a member of Congress to force a university president to fire a pro-terrorist, antisemitic faculty chair, then Columbia University leadership is failing Jewish students and its academic mission," added Stefanik. "No amount of overlawyered, overprepped, and over-consulted testimony is going to cover up for failure to act."

Shafik could have pointedly corrected the implications by the House inquisitors that it was Jewish students who needed protection. The reality was just the opposite: The danger was from the Israeli IDF students who attacked the demonstrators with military Skunk, with no punishment by Columbia.

Despite being told not to by the faculty and student groups (which Shafik was officially bound to consult), she called in the police, who arrested 107 students, tied their hands behind their backs and kept them that way for many hours as punishment while charging them for trespassing on Columbia's property. Shafik then suspended them from classes.

The clash between two kinds of Judaism: Zionist vs. assimilationist

A good number of these protestors being criticized were Jewish. Netanyahu and AIPAC have claimed – correctly, it seems – that the greatest danger to their current genocidal policies comes from the traditionally liberal Jewish middle-class population. Progressive Jewish groups have joined the uprisings at Columbia and other universities.

Early Zionism arose in late 19th-century Europe as a response to the violent pogroms killing Jews in Ukrainian cities such as Odessa and other Central European cities that were the center of anti-Semitism. Zionism promised to create a safe refuge. It made sense at a time when Jews were fleeing their countries to save their lives in countries that accepted them. They were the "Gazans" of their day.

After World War II and the horrors of the Holocaust, anti-Semitism became passé. Most Jews in the United States and other countries were being assimilated and becoming prosperous, most successfully in the United States. The past century has seen this success enable them to assimilate, while retaining the moral standard that ethnic and religious discrimination such as that which their forbears had suffered is wrong in principle.

Jewish activists were in the forefront of fighting for civil liberties, most visibly against anti-Black prejudice and violence in the 1960s and '70s, and against the Vietnam War. Many of my Jewish school friends in the 1950s bought Israel bonds, but thought of Israel as a socialist country and thought of volunteering to work on a kibbutz in the summer. There was no thought of antagonism, and I heard no mention of the Palestinian population when the phrase "a people without a land in a land without a people" was spoken.

But Zionism's leaders have remained obsessed with the old antagonisms in the wake of Nazism's murders of so many Jews. In many ways they have turned Nazism inside out, fearing a renewed attack from non-Jews. Driving the Arabs out of Israel and making it an apartheid state was just the opposite of what assimilationist Jews aimed at.

The moral stance of progressive Jews, and the ideal that Jews, blacks and members of all other religions and races should be treated equally, is the opposite of Israeli Zionism. In the hands of Netanyahu's Likud Party and the influx of right-wing supporters, Zionism asserts a claim to set Jewish people apart from the rest of their national population, and even from the rest of the world, as we are seeing today.

Claiming to speak for all Jews, living and dead, Netanyahu asserts that to criticize his genocide and the Palestinian holocaust, the nakba, is anti-Semitic. This is the position of Stefanik and her fellow committee members. It is an assertion that Jews owe their first allegiance to Israel, and hence to its ethnic cleansing and mass murder since last October. President Biden also has labeled the student demonstrations "antisemitic protests."

This claim in the circumstances of Israel's ongoing genocide is causing more anti-Semitism than anyone since Hitler. If people throughout the world come to adopt Netanyahu's and his cabinet's definition of anti-Semitism, how many, being repulsed by Israel's actions, will say, "If that is the case, then indeed I guess I'm anti-Semitic."

Netanyahu's slander against Judaism and what civilization should stand for

Netanyahu characterized the U.S. protests in an extremist speech on April 24 attacking American academic freedom.

What's happening in America's college campuses is horrific. Antisemitic mobs have taken over leading universities. They call for the annihilation of Israel, they attack Jewish students, they attack Jewish faculty. This is reminiscent of what happened in German universities in the 1930s. We see this exponential rise of antisemitism throughout America and throughout Western societies as Israel tries to defend itself against genocidal terrorists, genocidal terrorists who hide behind civilians.

It's unconscionable, it has to be stopped, it has to be condemned and condemned unequivocally. But that's not what happened. The response of several university presidents was shameful. Now, fortunately, state, local, federal officials, many of them have responded differently but there has to be more. More has to be done.

This is a call to make American universities into arms of a police state, imposing policies dictated by Israel's settler state. That call is being funded by a circular flow: Congress gives enormous subsidies to Israel, which recycles some of this money back into the election campaigns of politicians willing to serve their donors. It is the same policy that Ukraine uses when it employs U.S. "aid" by setting up well-funded lobbying organizations to back client politicians.

What kind of student and academic protest expressions could oppose the Gaza and West Bank genocide without explicitly threatening Jewish students? How about "Palestinians are human being too!" That is not aggressive. To make it more ecumenical, one could add "And so are the Russians, despite what Ukrainian neo-Nazis say."

I can understand why Israelis feel threatened by Palestinians. They know how many they have killed and brutalized to grab their land, killing just to "free" the land for themselves. They must think "If the Palestinians are like us, they must want to kill us, because of what we have done to them and there can never be a two-state solution and we can never live together, because this land was given to us by God."

Netanyahu fanned the flames after his April 24 speech by raising today's conflict to the level of a fight for civilization: "What is important now is for all of us, all of us who are interested and cherish our values and our civilization, to stand up together and to say enough is enough."

Is what Israel is doing, and what the United Nations, the International Court of Justice and most of the Global Majority oppose, really "our civilization"? Ethnic cleansing, genocide and treating the Palestinian population as conquered and to be expelled as subhumans is an assault on the most basic principles of civilization.

Peaceful students defending that universal concept of civilization are called terrorists and anti-Semites – by the terrorist Israeli Prime Minister. He is following the tactics of Joseph Goebbels: The way to mobilize a population to fight the enemy is to depict yourself as under attack. That was the Nazi public relations strategy, and it is the PR strategy of Israel today – and of many in the American Congress, in AIPAC and many related institutions that proclaim a morally offensive idea of civilization as the ethnic supremacy of a group sanctioned by God.

The real focus of the protests is the U.S. policy that is backing Israel's ethnic cleansing and genocide supported by last week's foreign "aid." It is also a protest against the corruption of Congressional politicians raising money from lobbyists representing foreign interests over those of the United States. Last week's "aid" bill also backed Ukraine, that other country presently engaged in ethnic cleansing, where House members waved Ukrainian flags, not those of the United States. Shortly before that, one Congressman wore his Israeli army uniform into Congress to advertise his priorities.

Zionism has gone far beyond Judaism. I've read that there are nine Christian Zionists for every Jewish Zionist. It is as if both groups are calling for the End Time to arrive, while insisting that support for the United Nations and the International Court of Justice condemning Israel for genocide is anti-Semitic.

What CAN the students at Columbia ask for

Students at Columbia and other universities have called for universities to disinvest in Israeli stocks, and also those of U.S. arms makers exporting to Israel. Given the fact that universities have become business organizations, I don't think that this is the most practical demand at present. Most important, it doesn't go to the heart of the principles at work.

What really is the big public relations issue is the unconditional U.S. backing for Israel come what may, with "anti-Semitism" the current propaganda epithet to characterize those who oppose genocide and brutal land grabbing.

They should insist on a public announcement by Columbia (and also Harvard and the University of Pennsylvania, who were equally obsequious to Rep. Stefanik) that they recognize that it is not anti-Semitic to condemn genocide, support the United Nations and denounce the U.S. veto.

They should insist that Columbia and the other universities making a sacrosanct promise not to call police onto academic grounds over issues of free speech.

They should insist that the president be fired for her one-sided support of Israeli violence against her students. In that demand they are in agreement with Rep. Stefanik's principle of protecting students, and that Dr. Shafik must go.

But there is one class of major offenders that should be held up for contempt: the donors who try to attack academic freedom by using their money to influence university policy and turn universities away from the role in supporting academic freedom and free speech. The students should insist that university administrators – the unpleasant opportunists standing above the faculty and students – must not only refuse such pressure but should join in publicly expressing shock over such covert political influence.

The problem is that American universities have become like Congress in basing their policy on attracting contributions from their donors. That is the academic equivalent of the Supreme Court's Citizens United ruling. Numerous Zionist funders have threatened to withdraw their contributions to Harvard, Columbia and other schools not following Netanyahu's demands to clamp down on opponents of genocide and defenders of the United Nations. These funders are the enemies of the students at such universities, and both students and faculty should insist on their removal. Just as Dr. Shafik's International Monetary Fund fell subject to its economists' protest that there must be "No more Argentinas," perhaps the Columbia students could chant "No More Shafiks."

By Michael Hudson at michael-hudson.com

Gaza – Civilization will Win over Barbarism

Nima April 22, 24

Michael's notes from this important interview. Watch the geo-political markers.

1A. US student and voter opposition to the US-Israeli genocide.

The breaking news here in New York City today are the mass protests at Columbia University, New York University and the New School opposing the genocide in Gaza. The protests have spread to Yale, Harvard and other universities throughout the United States. Columbia locked their gates, closing out students not only from their classes but from their dormitories and cafeterias. They are obliged to stay with friends or sleep outside. Over a hundred were arrested and their hands put in plastic tie-cuffs for many hours.

Students are furious at how the presidents of Harvard, University of Pennsylvania and Columbia have knuckled under the Congressional accusations that they are permitting anti-Semitic demonstrations on campus. One sign just show on television here says just what the Republican pro-Israel congresswoman Stefanik said that If you oppose genocide in Gaza, that's called anti-Semitism.

These hearings in Congress feature politicians seeking AIPAC money to wave the Israeli flag. This is the biggest scandal since the McCarthy hearings back in the 1950s that led to many actors, intellectuals, professors and government staffers to be fired and have their careers reckoned.

All three university presidents apologized for not preventing students from supporting the United Nations and the International Court of Justice. Not a single one said, "I'm proud that our students are standing up for what's fair, and for supporting the United Nations and the rule of international law. This shows how moral and committed students are to opposing unfair one-sided bombing of a population as part of ethnic cleansing to create a Holocaust waged by Zionists themselves."

No university president said this. Their cowardice showed that their first concern was donors to their endowments, not to their students. The US-Israeli war on the Palestinians has caused a crisis in academic freedom. Today, Columbia University has closed down all its in-person classes to prevent further student protests against the genocide in Gaza.

For the first time since the threat wave of student protests against the Vietnam War in the 1960s, and soon after that, the protests against South African apartheid, students are demonstrating against the U.S. bombing of civilian populations. The Democratic Party is upset because this means that Biden probably cannot possibly win in November. I remember back in the 1960s, President Lyndon Johnson couldn't speak at any hotel or other public space without having to sneak out a side door to avoid crowds chanting, "LBJ, LBJ, how many kids did you kill today."

Something like that is happening with President Biden. Crowds gather and chant against his war-making from Israel to Ukraine, and chant,

"Bomber Joe has got to go."

Younger voters share a revulsion against his fighting to the last Ukrainians and his war on the Palestinians. Many Americans are refusing to vote Democratic – or Republican. Third-party candidates are gaining support, headed by Jill Stein and RFK Jr. What's amazing is that the only anti-war candidate who's on the ballot is Jill Stein. The Democratic Party is trying to get her and any other challengers off the ballot – just as in Ukraine, Zelensky has cancelled elections and banned other parties.

The opposition to the Democrat and Republican neocon Deep State threatens a deadlock between the two awful candidates, Biden and Trump. A likely result is that if neither of the two major party candidates has over 50% of the vote, this November's election will end up throwing the election into the House of Representatives. The balance will then lie with the third-party electors, who can make the kind of deals that European parliamentary states negotiate.

This election is heavily influenced by money from AIPAC – the Zionist lobbying organization. While they attack critics of Netanyahu and Israel as being anti-Semitic, he has said that the great public relations problem is created by Jewish liberals! They are against genocide. And they are demonstrating on campuses across the United States.

Colleges are punishing supporters of Gaza as if they want to destroy Israel. The university's president claims that Jewish students feel threatened, but the reality is Zionist violence. At Columbia, students who have served in Israeli IDF forces have sprayed pro-Palestinian demonstrators with Skunk, an indelible chemical. Columbia University did nothing to protect or help the students under attack.

This is what Freud called projection: The Zionists are projecting onto their victims the genocide that THEY want to perform against Palestinians and other Near Easterners – Arabs, Persians and beyond.

This claim that "To criticize Israel is to be anti-Semitic" sets Zionists against the great majority of Jews who have been thoroughly assimilated over the past 75 years. Anti-Semitism has been frowned upon for over half a century. Netanyahu, Biden, and Columbia's president are saying that if you support the United Nations and the International Court of Justice, you're anti-Semitic. If you oppose Gaza genocide and criticize Israel, you're ant-Semitic." The implication is that the whole world who has criticized this violence and breaking of international law is anti-Semitic.

At some point, many will begin to say, "All right. I guess I'm anti-Semitic." Netanyahu, Biden and AIPAC may be creating the most anti-Semites since Hitler!

Columbia University president Nemit Shafik has said that protests against the Gaza genocide are anti-Semitic, demanding genocide against Jews. She called out the police to break up student demonstrations, arrested over a hundred students, cancelled their IDs, prevented them from returning to their dormitories or completing their exams. All this as a sign to Columbia's trustees that she would not hear of any support for the UN, ICJ or their criticisms of Israeli behavior.

When the Congressional right-wingers demanded that she accuse calls to stop killing Palestinians as calls for the extermination of Israelis – by not letting them "protect themselves" – she didn't stand up and say that she was proud that these students are defending the United Nations and the International Court of Justice. She said that she will expel the students, expel professors who oppose the genocide, and stand with opposing any anti-war stance. This is not surprising.

Columbia's president Shafik worked for the IMF and the World Bank on behalf of the United States' right-wing. She has fully backed Netanyahu's claims that to criticize Israel is to be anti-Semitic.

1. Your take on Gaza, and the new escalations between Iran and Israel – who's benefiting?

Well, no matter what, Palestinians are losing. The Gaza bombing has resumed, and the killing has spread to the West Bank.

It's hard to say that Israel is winning. It's doing all the killing, but it is becoming an outcast.

So is the United States. Biden's pretense to dissociate the United States from Israel has backfired. The world sees it as absurd when he asks Netanyahu to please "be kind and follow the rules of war" while it's breaking international law by bombing hospitals, shooting doctors and especially journalists, using Gazan civilians for target practice, bombing Iran's embassy in Syria. Biden's pretense is that the US is not encouraging Israel to keep on wiping out Palestinians as Israel's Final Solution. But that obviously is his policy and that of his neocon team, Blinken and Jake Sullivan.

They keep giving Israel a steady flow of bombs and money. If you look at the U.S. actions, they are saying: "Go right ahead. We just don't want to be blamed for it. We want to preserve deniability so as to save our moral credibility." But that credibility is now gone – as irreversibly as that of Israel. Their pretense of asking Netanyahu to be more gentle – while giving him more big bombs every week – seems to be saying, "We know that giving Israel arms and money is bad. But it's all Netanyahu's fault. We wish he could exterminate Palestinians in a nicer way."

Likewise when Biden and Blinken make public statements telling Israel NOT to bomb Iran, this has been a common U.S.-Israeli goal for many years. The Neocons have given Netanyahu the go-ahead to make Israel something more than just a "landed aircraft carrier" and on-site manager of Isis. It is to be an outright armed attacker.

The problem is that militarily, there seems to be no way for Israel to avoid being hurt. The neocons have seen that as the United States is losing world power and support, and even losing its military superiority. The best time for a war in the Middle East against Iran – and simultaneously against Russia and China – is now, rather than later.

Or I should say, the "least bad" time to fight Iran. This is their last big chance, with a crazy Israeli leader in Netanyahu and equally crazy rival politicians waiting to step in and follow the same policy, which seems to be that of the Israeli population as a whole.

But Russia and also China have signalled very strongly that they will protect Iran. If it is hit, Iran will be protected, and it will wipe out Israel.

I think that when the dust settles, Iran will come out ahead, Israel will self-destruct and the United States will be isolated from the rest of the world outside of its NATO partners and client states.

The violence in Gaza and the West Bank is reminiscent of the 19th century's colonization practices wiping out indigenous populations that the Global Majority feel themselves pressed to create an alternative. They see Israel as pursuing what European colonial powers did in the 19th century.

The Europeans have apologized for what they did, and most Americans sympathize with the native "Indians" killed so that the Slave Power could use their lands for cotton and tobacco, driving them further and further West, breaking one treaty after another. That is how settler states behave.

But until Israel, that was thought to be a bygone relic of European colonialism.

The world sees this happening again today – with an abhorrent sanctimonious self-justification that Israel is "protecting itself." Its view is that it has behaved so brutally and Nazi-like against the Palestinians that they MUST want to fight back and kill them. Israeli aggressors thus are projecting their own behavior and hatred onto their victims.

So to answer your question about who is the winner: This awful genocidal attack has introduced a note of urgency on the part of the Global Majority: the BRICS+ countries, the Global South and Eurasia.

I think that this is a turning point in Western civilization, away from Western intolerance, unipolar demand for control, and the institutions of US control created in 1944-1945.

This is an attempt to obliterate the rules of international law and leave only U.S. power in its place. This constant vetoing of UN rules and the International Court of Justice condemning Israel for genocide, for breaking all international rules by bombing foreign embassies, means that the United Nations is effectively dead.

The United States just vetoed the attempt to recognize Palestine as a nation. This veto shows that Biden wants Palestinians exterminated so as to use Israeli power to destabilize the Near East, to continue its role in mobilizing ISIS terrorism and act as the warhead in the U.S. attack on Near Eastern countries seeking independence from U.S. control.

Only a full spectrum set of international institutions can enable other countries to break free. So the ultimate loser is the dream of U.S. unipolar power.

The winners and losers thus go far beyond just Iran and Israel. This is really a conflict of civilizations. And I hope that civilization will win over barbarism.

2. Is Ukraine about to collapse since the far-right soldiers are surrendering and not willing to continue though we still see the US sending more aid?

Ukraine already has collapsed, not only militarily but politically and socially. The Azov Battalion and other far-right soldiers are not surrendering, because they have been protected by staying behind the front. They have spent their time mainly attacking and terrorizing civilians.

The civilian population is doing everything that it can to avoid being rounded up and thrown into the front lines without proper training. These are the Ukrainian troops who are defecting to the Russian army.

The U.S. Congress just passed the aid package for Ukraine on Sunday. But the Christian Zionist Republican leader Mike Johnson, appointed by Trump, followed President Biden in making it clear that the aid was going to be spent in the United States, on U.S. arms production – employing U.S. labor – not on money sent to Ukraine.

Many Congresspersons were waiving Ukrainian flags on the floor. That's almost as serious a breach of rules as the Congressman who walked in wearing his Israeli IDF uniform –to show where his loyalty really lies.

3. Olaf Scholz visiting China trying to convince them not to help Russia. Are the EU and US able to separate China and Russia? How deep is the partnership between these two countries?

The US attack on China and Russia – and Iran and most of the Global Majority – has driven China and Russia together, and indeed more of the world together to protect themselves against US constant destabilization, regime change and political attacks.

I would have thought that the Chinese would simply laugh at Scholz, but they are being as polite to him as they were to Treasury Secretary Yellen a few weeks ago when she made similar demands. They will smile and say that they understand what they are being asked to do, but they will continue to support Russia.

There is no way that the United States can drive a wedge between China and Russia, because Biden has said again and again that America's number one long-term existential enemy is China, and that to defeat it – perhaps by going to war as early as 2026 – is to conquer Russia so that Russia cannot provide defense to the planned US-China War.

China is acting in a way that must surprise much of the West by still trying to hope that it can persuade the US neocons, Democrats and Republicans that there is a win-win alternative to war.

The Western art of persuasion: to hurt, bomb, injure, overthrow in regime change.

The rest of the world, from antiquity through China: persuasion by finding a win-win solution. Leave the existing elites in place. That is what Persia did, and Genghis Khan.

4. Please take a look at the attached file of China's rising trade. Where is China's economy heading?

China is filling the economic vacuum caused by the US and NATO-Europe de-industrializing. Its official policy is socialism, but this turns out in practice to be the same basic economic practice of subsidy, infrastructure spending and rising living standards that the United States and Germany pursued in the late 19th century as the basic policy of industrial capitalism – which itself was evolving toward socialism.

China has thus achieved the policies that the United States and Germany originally followed so successfully. But the U.S. and European capitalism is no longer industrial. It is finance capitalism.

The US policy realizes that American and European economies are priced out of the market by deteriorating into rentier-capitalist economies. That is why the bill to support Ukraine and Israel, and to stir up Taiwan in hopes that like Ukraine, it will fight to the last Taiwanese against China, included a demand that China sell Tik-Tok.

The US wants to become a rentier economy living on the monopoly rents by controlling internet platforms, computer-chip technology and Artificial Intelligence crapification.

But here's the problem for the United States. Getting technological leadership involves R&D. But this costs money – and Amazon, Google, Meta and others use their revenue to push up stock prices in the SHORT RUN by stock buybacks and dividend payouts, not for long-term R&D. So that is the big problem.

The more immediate problem is that the US sanctions against selling critical computer-chip and information technology to China has led it to realize that it must become totally independent of U.S. suppliers. U.S. chipmakers have complained to Biden that losing the Chinese market by obeying these sanctions will deprive them of the revenue needed to make the capital investment needed to compete.

So the US attempt to isolate and hurt China and all other countries seeking to increase their self-dependency is turning out to isolate the United States itself. That is the irony of U.S. self-destructive policy based on hurting other countries as a means of controlling them instead of trying to offer mutual gains as China and the rest of the civilized world are doing as their basic approach.

This is why civilization is surviving over barbarism.

Tue, 30 Apr 2024 11:31:27 +0000

5. A Russian Summer Offensive?

October Surprises arrive early this year for the drowning Biden regime??

In this episode of the Grand Strategy with Major General (Retd) GD Bakshi,

he delves into geopolitical tensions surrounding Ukraine, focusing on Russia's military strategies, the impact of dense air defense environments, and the anticipation of a Russian counteroffensive.

he delves into geopolitical tensions surrounding Ukraine, focusing on Russia's military strategies, the impact of dense air defense environments, and the anticipation of a Russian counteroffensive.

It critiques Western expectations of economic sanctions against Russia, highlighting Russia's resilience. The speaker warns against underestimating Russia's military capabilities and urges caution in provoking further conflict.

It critiques Western expectations of economic sanctions against Russia, highlighting Russia's resilience. The speaker warns against underestimating Russia's military capabilities and urges caution in provoking further conflict.

Additionally, the episode discusses the Israeli-Palestinian conflict, emphasizing the challenges of targeting Hamas leadership underground.

Additionally, the episode discusses the Israeli-Palestinian conflict, emphasizing the challenges of targeting Hamas leadership underground.

It concludes by addressing potential flashpoints in the South China Sea and Taiwan Strait, expressing concern over escalating global tensions and the risk of a devastating war. Overall, the situation calls for diplomatic solutions to prevent catastrophic outcomes.

It concludes by addressing potential flashpoints in the South China Sea and Taiwan Strait, expressing concern over escalating global tensions and the risk of a devastating war. Overall, the situation calls for diplomatic solutions to prevent catastrophic outcomes.

Tue, 30 Apr 2024 08:03:13 +0000

6. Palestinian Resistance Update

The last week's Gaza rocketry, tactics, Abu Obaidah speech, and the growing West Bank guerrilla warfare with Jon Elmer